$SPY Option Analysis Setups: Calls Building At Current Levels

Weekly Recap:

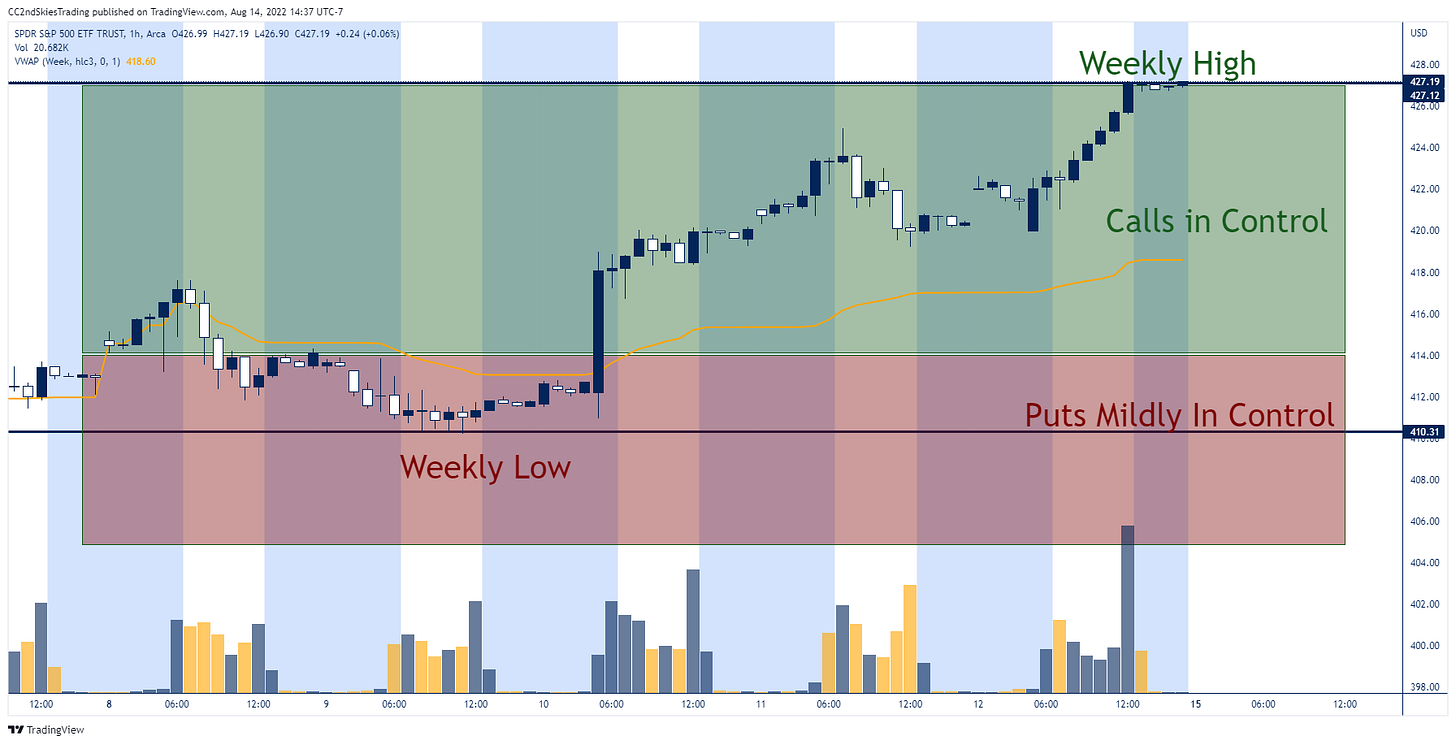

● SPY had a productive week for bulls, closing above 420 + adding calls above

● ST we’re expecting pullbacks to be bought with 420 being solid support

● Until we get a daily close below 415, we’re staying bullish

● 420 should remain upside resistance to start the week, perhaps longer

Major Market Indices & Option Flows

1: S&P 500 ETF ($SPY)

Last week markets started off pulling back into the 410 support but launched post CPI coming in less than expected. Traders got ‘risk-on’ post the CPI print jumping almost 15 points over 3 sessions.

The most constructive part of last weeks option flows was the a) breaking above 420, b) pulling back into 420 and holding it as support, along with c) calls building above 420 into 430.

This last part shifted the concentrations of calls up between 420-430 which gives traders an upside target for the op-ex.