Option Analysis Setups: FOMC on Deck, Markets in Waiting Mode for Potential Big Moves

Weekly Recap:

● Last week a hot CPI on Tues sparked a massive sell-off, losing 4% in one day

● Markets drifted lower the rest of the week with mild gains on Friday

● With the VIX & SEP op-ex off the table, it’s all about the FOMC Wednesday

● A hawkish FOMC could push SPY towards yearly lows while a bullish one could lead to a market rally

Major Market Indices & Option Flows

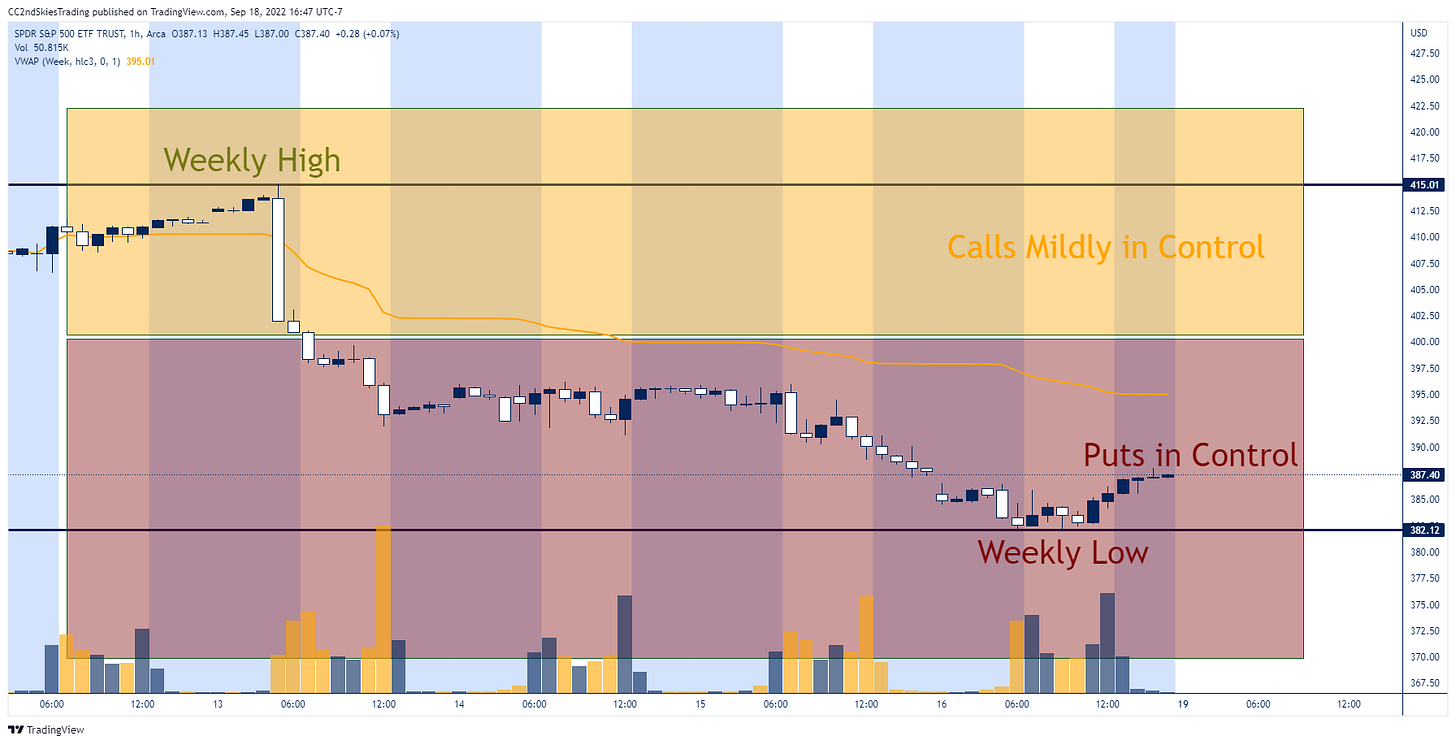

1: S&P 500 ETF ($SPY)

Last week markets started off anticipating the key CPI on Tuesday. That print came in overly hot, leaving bullish traders caught off guard while the markets liquidated and lost 4% in one day. Of note – it’s the first time we’ve seen in years that the S&P 500 lost 4% while VIX did not break 30.

Be that as it may, SPY’s trekked lower all week with a mild pullback on Friday due to puts expiring.

For this week, it’s all about the FOMC which we think should create a strong directional response in either direction.

We expect markets to consolidate late Mon till Weds morning before the FOMC at 2pm EST.